: 9638022311, 8140149940(09.00AM to 06.00 PM)

: [email protected] :Opp Deesa Court, Above Maharashtra Bank, Deesa

: 9638022311, 8140149940(09.00AM to 06.00 PM)

: [email protected] :Opp Deesa Court, Above Maharashtra Bank, Deesa

Permanent Account Number (PAN) is a ten-digit alpha numeric number, issued in the form of a laminated card, by the Income Tax Department, to any "person" who Applies for it or to whom the department allots the number without an application. PAN enables the department to link all transactions of the "person" with the Department. These transactions include tax payments, TDS/TCS credits, returns of Income/wealth/gift/FBT, specified transactions, correspondence, and so on.

PAN, thus, acts as an identifier for the "person" with the tax department. PAN was introduced to facilitates linking of various documents, including payment of taxes, assessment, tax demand, tax arrears etc. relating to an assesses, to facilitate easy retrieval of information and to facilitate matching of information relating to investment, raising of loans and other business activities of taxpayers collected through various sources, both internal as well as external, for detecting and combating tax evasion and widening of tax base.

Types of Income Tax Return Forms : - To file tax returns Income Tax Department had issued a series of forms applicable to different type of assesses:

ITR 1 : For Individuals having Income from Salaries, one house property, other sources (interest etc.) and having total income up to Rs.50 lakh.

ITR 2 : This form is applicable For Individual & HUFs not carrying out business or profession under any proprietorship.

ITR 3 : This form is applicable For Individuals & HUFs having income from a proprietary business or profession.

ITR 4 : This form is applicable For presumptive income from Business & Profession.

ITR 5 : This form is applicable for a For persons other than – (i) individual,(ii)HUF, (iii) company, and (iv)person filling ITR-7

ITR 6 : This form is applicable For Companies other than companies claiming exemption under section 11

ITR 7 : This form is applicable For persons including companies required to furnish return under section 139(A) or section (1394B) or section 139(4C) or section 139(4D) or section 139(4E)

A trademark is any word (PEPSI), name (TATA), symbol or device (Microsoft), slogan (Yeh Pyaas Hai Badi & Thanda Matlab Coca Cola), package design (Coca-Cola bottle) or combination of these that serves to identify and distinguishes a specific product from others in the market place or in trade. Even a sound (Britannia chimes) color combination, smell or hologram can be a trademark under some circumstances. The term trademark is often used interchangeably to identify a trademark or service mark.

Time taken for application for registration is 7 working days from the time you appoint us for the work. Time taken for certificate of Registration of trademark is about 18 to 20 months.

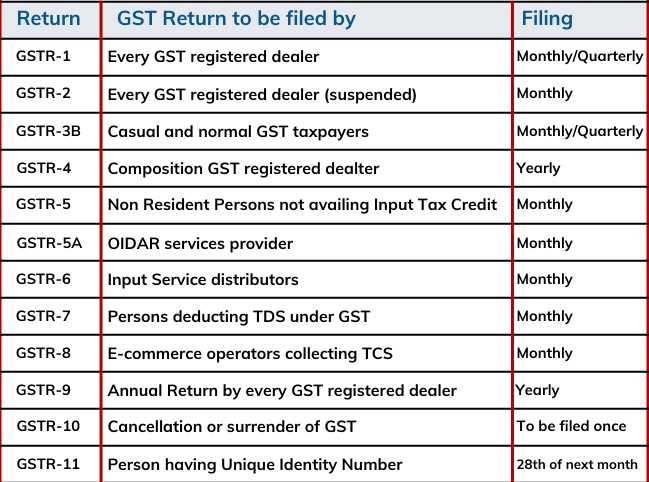

Goods & Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that will be levied on every value addition. In simple words, GST is an indirect tax levied on the supply of goods and services. GST Law has replaced many indirect tax laws that previously existed in India.

Under the GST regime, tax will be levied at every point of sale.

Now let us try to understand “GST is a comprehensive, multi-stage, destination-based tax that will be levied on every value addition.”

There are multiple change-of-hands an item goes through along its supply chain : from manufacture to final sale to consumer.

Let us consider the following case:

India is a federal democracy that is one which has clear demarcation of powers, responsibility and revenue collection between the states and the centre in its constitution. For example law and order falls under the state’s jurisdiction while the nation’s defence is the centre’s responsibility. The GST too needs to have clear provisions on what areas the centre and the state are allowed to collect revenue from taxation to prevent an overlapping.

The Central GST or CGST is the areas where the centre has the powers and State GST where the State has taxation capabilities. The IGST or Integrated GST is for movement of goods within the states of the Indian union. This will be collected by the union however will be transferred over to the states. Thus it is essential that if and when the GST comes out it is rolled over in the entire nation simultaneously.

In corporate accounting , commerce students have to learn accounting treatment of issue of share capital , debenture and its redemption , bonus and right issue at graduation level . They also have to solve the problems of final accounts of different companies .

For proper accounting treatment , learning of Indian Company Law 1956 is must . So , this topic is being discussed here. If you are starting to learn Company or Corporate Accounting , then this article will be useful for you because after reading this article , you will understand , the brief history , meaning , definition of Company and its six features .

First of All, in France this word was used for body of soldiers see [Fr. Term Accompanied].. After year 1500, this word became famous in business. Group of businessmen was called company.

Example

I can explain the meaning of company with a simple example. Suppose, two persons want to do business at large scale but they have limited money. They are also not interested to make partnership due to its unlimited liability. They go to the office of registrar of companies and fill the form of creation of company and attaching required documents. They also pay the required fees. After this, registrar will register their company. This registered company will be independent Identity.

Indian Company law 1956's section 3(1) (i) define company, "Company is the Organization which is formed and registered under this law or any previous law"

From above example and definition, we can understand that company is voluntary and autonomous association of persons. This is made for achieving business objectives. It acts like human being. Company can purchase assets or sell it. It can take also debt. It can open bank account. It is fully free from its members. Company is operated through board of directors.

List of documents required for Company Incorporation in India

Details of at-least two Directors / Promoters of the company for obtaining DIN (Director's Identifications Number)

Thereafter a provisional DIN would be obtained from the Ministry of Company Affairs and a copy would be send for obtaining signature of the applicant. In case of foreign residents the documents i.e. DIN Form, Proof of Identity and Proof of Residence have to be attested by notary of the home country. Details of proposed company to be incorporated THREE Proposed names of the company in order of preference. Main objects of the proposed company.

Copyrights means the Right to Copy or reproduce the work in which Copyright subsists. The Copyright vests in original work in whatever form it may be i.e. Literary, Artistic, etc. The registration of Copyright in India is not mandatory but useful in courts where Civil and / or Criminal Proceeding can be taken to protect it.Our services for copyright registration India, cover all types of creations and works under the broad categories of literary, artistic, photographic, musical, choreographic, cinematographic, sculptural, etc. Therefore, books, poems, novels, contented written article, diverse documents, audio and visual recordings, musical collections, paintings and drawing, architectural designs and layouts, films and movies, sculptural creations, and so on, are expeditiously and economically registered by our dedicated and flawless copyright services India. The copyright registration under Copyright Act, 1957 provides copyright protection in all across the entire country.

REQUIREMENTS FOR MAKING COPYRIGHTS APPLICATION

ISO, the International Organization for Standardization, promotes global Standardization for specifications and requirements for materials, products, procedures, formats, information and quality management. Certification under ISO standards is an assurance that the ISO-required management of processes and documentation is in place.

ISO 9001 Certification IRCA Training & Certificates. TVE CERT Provides Accredited Certificates

ISO is an international body that standardizes how businesses and organizations involved in commerce and industry manage information and processes. The ISO does not enforce regulations. Certification

An ISO certification is not a license that permits an activity. It merely certifies that a management system, manufacturing process, service or documentation procedure has all the requirements for Standardization and quality assurance.

The specific requirements and operating procedures are the responsibility of the individual business or organization. ISO standards and systems are tools that allow efficient implementation and communication, so that any organization in any country is able to conduct business with any other.

Most ISO standards are specific to processes or products. However, ISO 9001 and ISO 14001 are generic management system standards that can be applied to any organization. They are the most

ISO 9001 and 14001

ISO 9001 is a set of requirements for quality-management systems and ISO 14001 is for environmental-management systems. Neither regulates what is done or should be done by an organization but each establishes a framework for effective operation.

Certification in either ISO 9001 or ISO 14001 involves a series of internal audits and ISO audits to ensure that all procedural requirements and documentations are adhered to during every day practices